Analysis by M. Brian Riley

Note: All financial figures presented in US$.

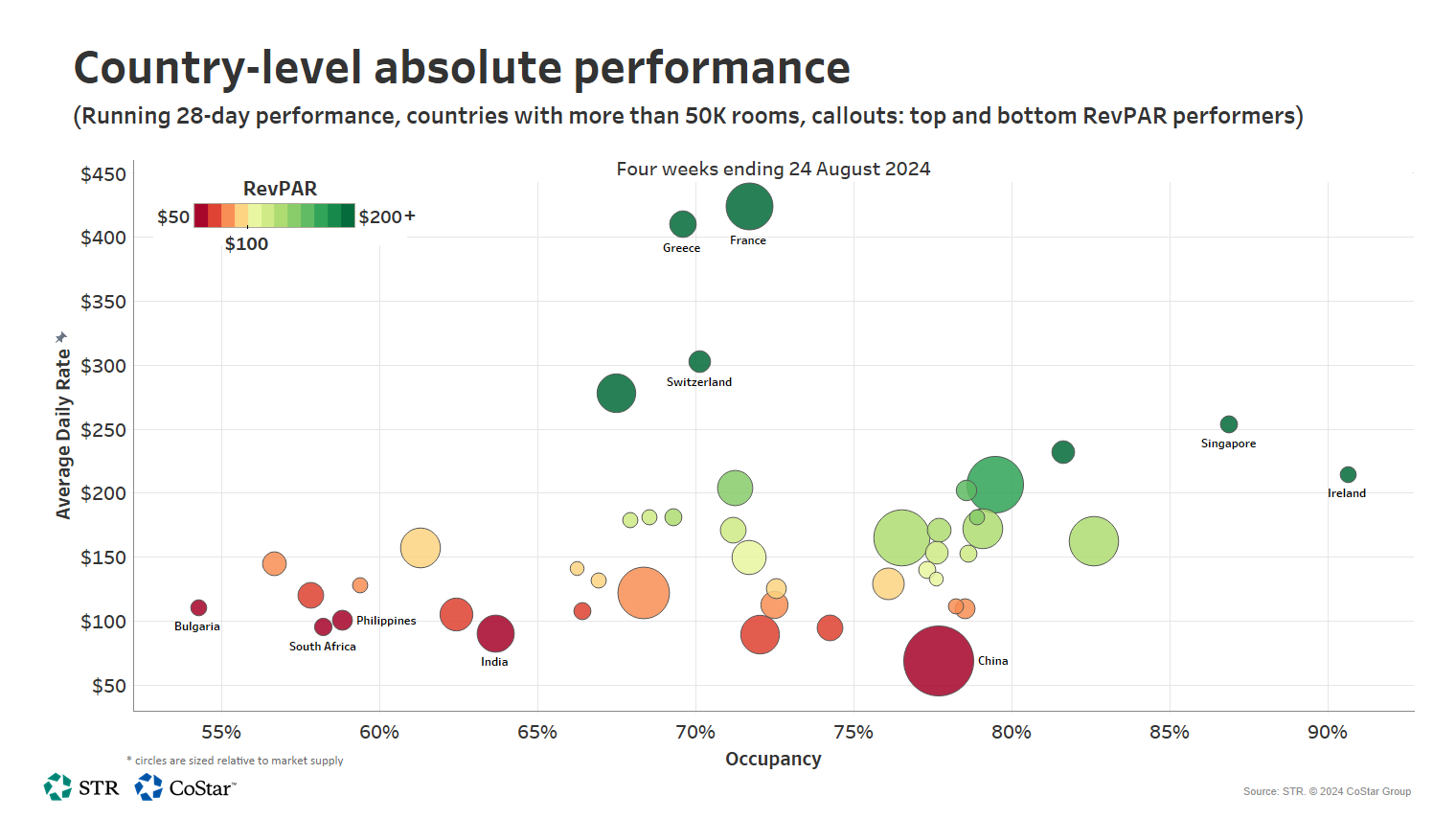

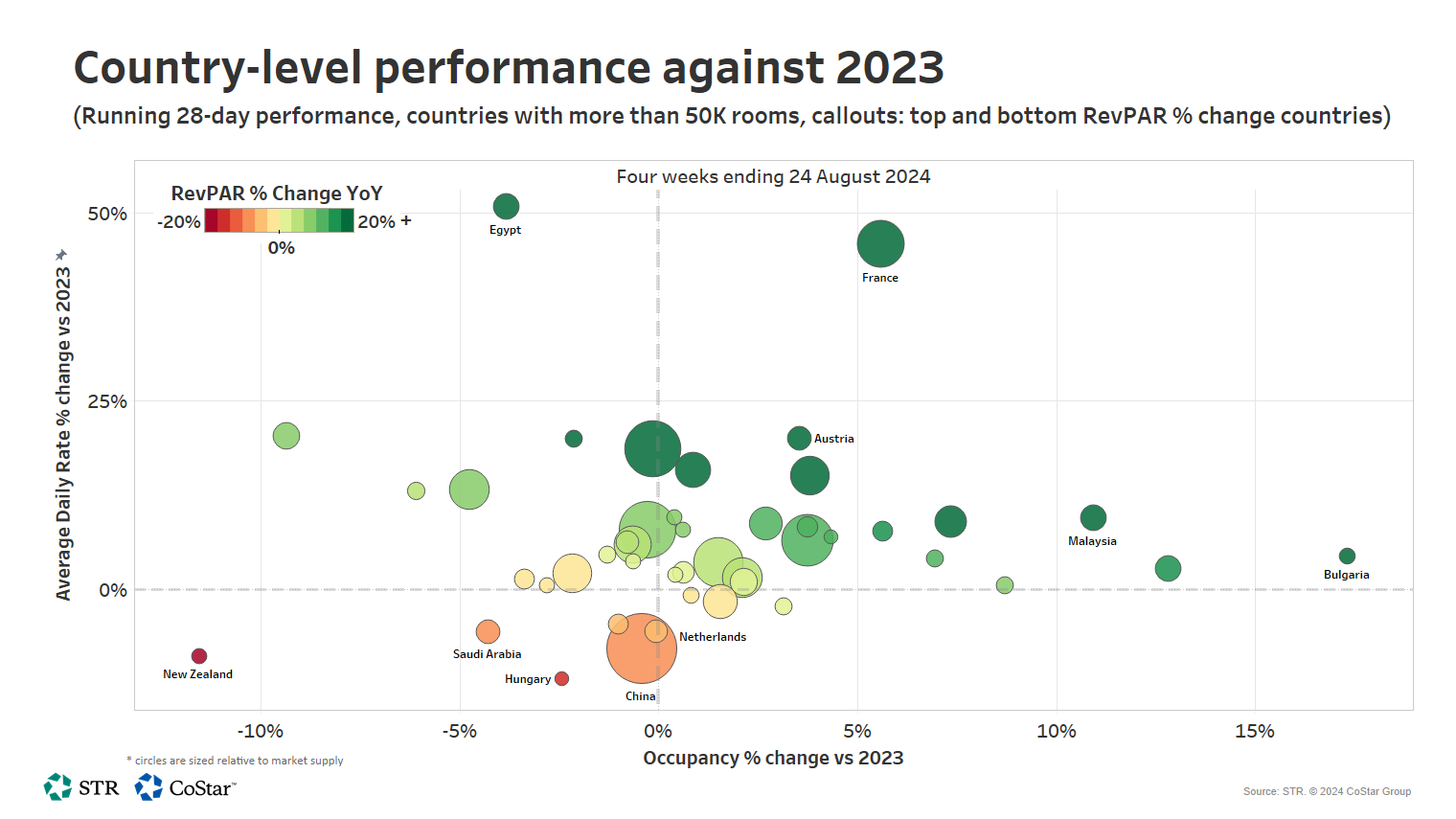

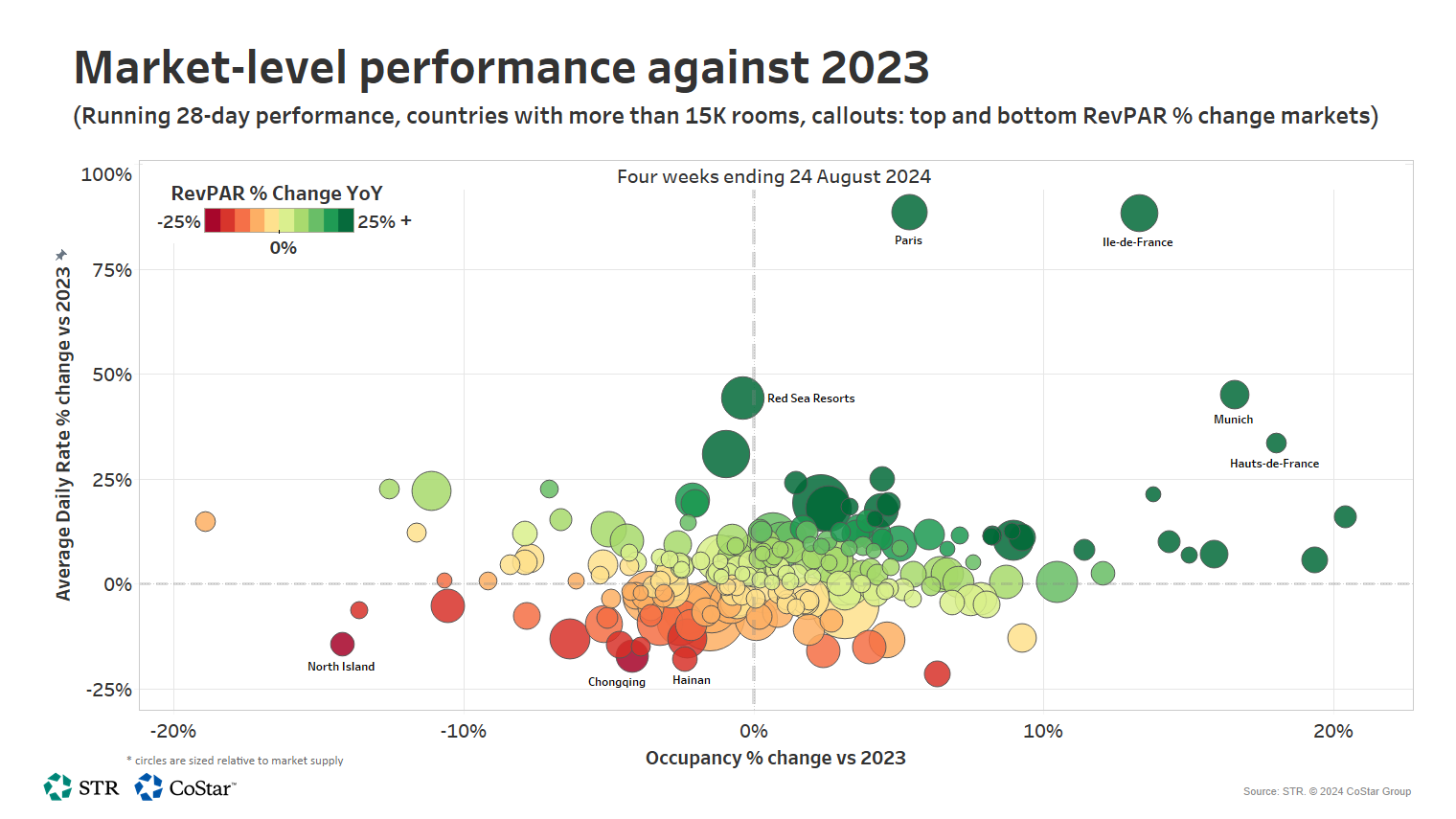

STR's global "bubble chart" update for the four weeks ending 24 August 2024 shows 61% of markets with year-over-year growth in revenue per available room (RevPAR). That was a three-point decline in the proportion of global markets (64%) experiencing matched four-week RevPAR gains in last month's update.