June 2023 Top-Line Metrics (percentage change from June 2022)

- Occupancy: 69.7% (-0.4%)

- Average daily rate (ADR): US$158.40 (+2.3%)

- Revenue per available room (RevPAR): US$110.33 (+1.9%)

Key points

- U.S. hotel demand declined slightly year over year, but modest supply growth helped mitigate the impact on occupancy.

- Another month of moderate ADR growth (+2.3%) led RevPAR to rise 1.9%.

- Normalization continues to be the theme of U.S. hotel performance, as weekend occupancy declined, and weekday occupancy increased relative to 2022.

- Chain-scale performance further supports normalization, as high-end (Luxury/Upper Upscale) hotel demand grew, and Midscale/Economy hotel demand declined in June.

- Luxury chains reported further softening in ADR as the balance between Luxury and Upper Upscale ADR slowly reverts to the longer-term average.

- Transient demand growth outpaced group demand growth for the first time since early 2021 as the group demand equation included a difficult year-over-year comparison.

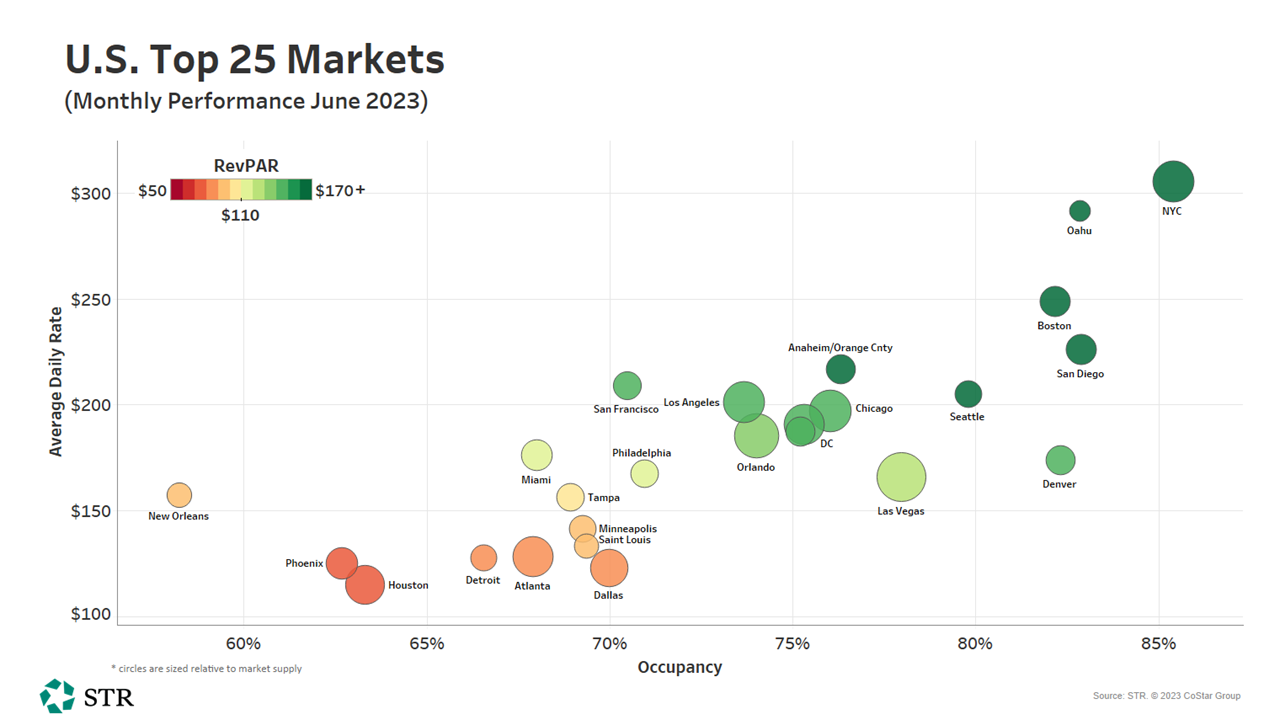

- The Top 25 Markets continued to be a demand bright spot, growing 0.6% in June and 0.7% for the quarter.

- The volume of rooms under construction remained stable.

The modest occupancy decline, which was underpinned by a 0.1% demand decline, moderated pricing power.