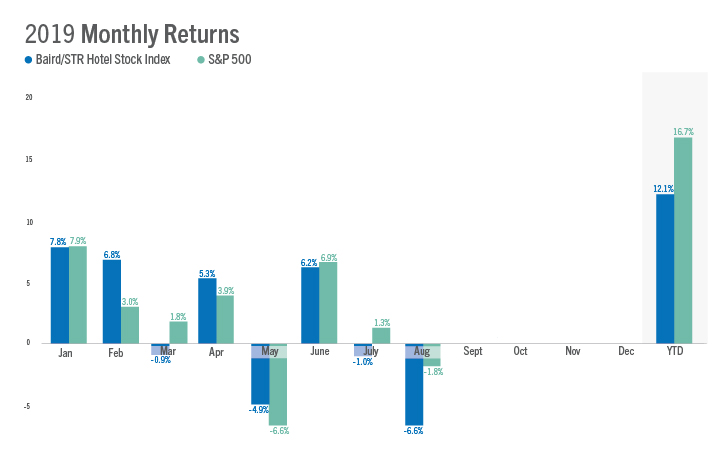

HENDERSONVILLE, Tennessee, and MILWAUKEE—The Baird/STR Hotel Stock Index dropped 6.6% in August to 4,561. Year to date through the first eight months of 2019, the index is up 12.1%.

“Hotel stocks declined and underperformed their benchmarks again in August as macroeconomic concerns continue to be front and center for investors,” said Michael Bellisario, senior hotel research analyst and VP at Baird. “RevPAR trends have been sluggish lately, broader growth uncertainties remain a headwind for investor sentiment and most hotel management teams expect the slow pace of growth to continue for the remainder of the year, all of which has caused hotel stocks to be relative underperformers in recent months.”

“The current performance environment is a seesaw with stops at good, ok and poor news,” said Amanda Hite, STR’s president and CEO. “In July, the industry sold more rooms than any other month on record, and the RevPAR upcycle hit a record 111 months in a 113-month span. But ADR growth of 0.7% in July and 1.1% year to date is below or just at the level of inflation, which does not bode well for profit growth. All chain scales and classes are equally affected by the lack of ADR and RevPAR growth, and as our latest forecast projects, we do not expect the fundamentals to change rapidly in either direction.”

August performance of the Baird/STR Hotel Stock Index was behind both the S&P 500 (-1.8%) and the MSCI US REIT Index (+3.1%).

The Hotel Brand sub-index decreased 7.5% from July to 7,254 while the Hotel REIT sub-index declined 4.5% to 1,407.

About the Baird/STR Hotel Stock Index and Sub-Indices

The Baird/STR Hotel Stock Index was set to equal 1,000 on 1 January 2000. Last cycle, the Index peaked at 3,178 on 5 July 2007. The Index’s low point occurred on 6 March 2009 when it dropped to 573.

The Hotel Brand sub-index was set to equal 1,000 on 1 January 2000. Last cycle, the sub-index peaked at 3,407 on 5 July 2007. The sub-index’s low point occurred on 6 March 2009 when it dropped to 722.

The Hotel REIT sub-index was set to equal 1,000 on 1 January 2000. Last cycle, the sub-index peaked at 2,555 on 2 February 2007. The sub-index’s low point occurred on 5 March 2009 when it dropped to 298.

The Baird/STR Hotel Stock Index and sub-indices are available exclusively on www.HotelNewsNow.com. The indices are cobranded and were created by Robert W. Baird & Co. (Baird) and STR. The market-cap-weighted, price-only indices comprise 20 of the largest market-capitalization hotel companies publicly traded on a U.S. exchange and attempt to characterize the performance of hotel stocks. The Index and sub-indices are maintained by Baird and hosted on Hotel News Now, are not actively managed, and no direct investment can be made in them.

As of 31 August 2019, the companies that comprised the Baird/STR Hotel Stock Index included: Apple Hospitality REIT, Chatham Lodging Trust, Chesapeake Lodging Trust, Choice Hotels International, DiamondRock Hospitality Company, Extended Stay America, Hilton Inc., Hospitality Properties Trust, Host Hotels & Resorts, Hyatt Hotels, InterContinental Hotels Group, Marriott International, Park Hotels & Resorts, Inc., Pebblebrook Hotel Trust, RLJ Lodging Trust, Ryman Hospitality Properties, Summit Hotel Properties, Sunstone Hotel Investors, Wyndham Hotels & Resorts, and Xenia Hotels & Resorts.

This communication is not a call to action to engage in a securities transaction and has not been individually tailored to a specific client or targeted group of clients. Research reports on the companies identified in this communication are provided by Robert W. Baird & Co. Incorporated, and are available to clients through their Baird Financial Advisor. This communication does not provide recipients with information or advice that is sufficient on which to base an investment decision. This communication does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this communication as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this release.

About Baird

Celebrating its 100th anniversary in 2019, Baird is an employee-owned, international wealth management, asset management, investment banking/capital markets, and private equity firm with offices in the United States, Europe and Asia. Baird has approximately 4,500 associates serving the needs of individual, corporate, institutional and municipal clients and more than $208 billion in client assets as of Dec. 31, 2018. Committed to being a great workplace, Baird ranked No. 12 on FORTUNE’s 2018 100 Best Companies to Work For list. Baird is the marketing name of Baird Financial Group. Baird’s principal operating subsidiaries are Robert W. Baird & Co. Incorporated in the United States and Robert W. Baird Group Ltd. in Europe. Baird also has an operating subsidiary in Asia supporting Baird’s investment banking and private equity operations. For more information, please visit Baird’s website at www.rwbaird.com.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for global hospitality sectors. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. For more information, please visit str.com.

Media Contacts:

Nick Minerd

STR – Senior Director, Communications

nminerd@str.com

+1 (615) 824-8664 ext. 3305

Ashley Bakke

Baird Public Relations

publicrelations@rwbaird.com

+1 (414) 765-7250

0 Comments