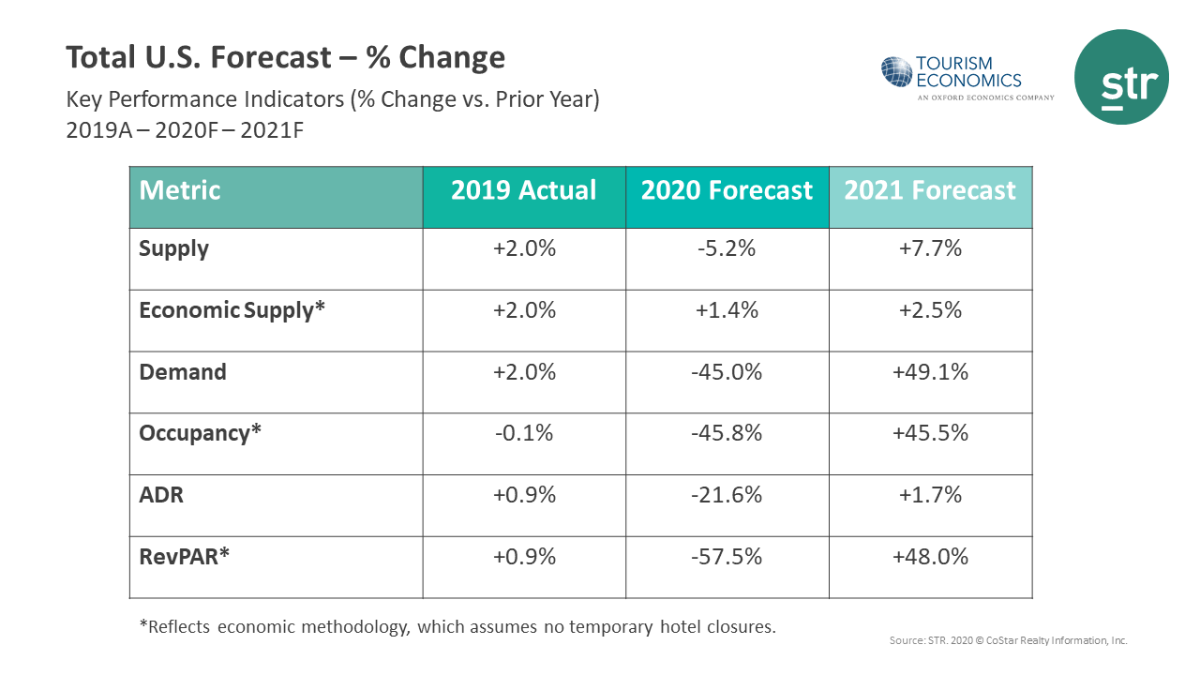

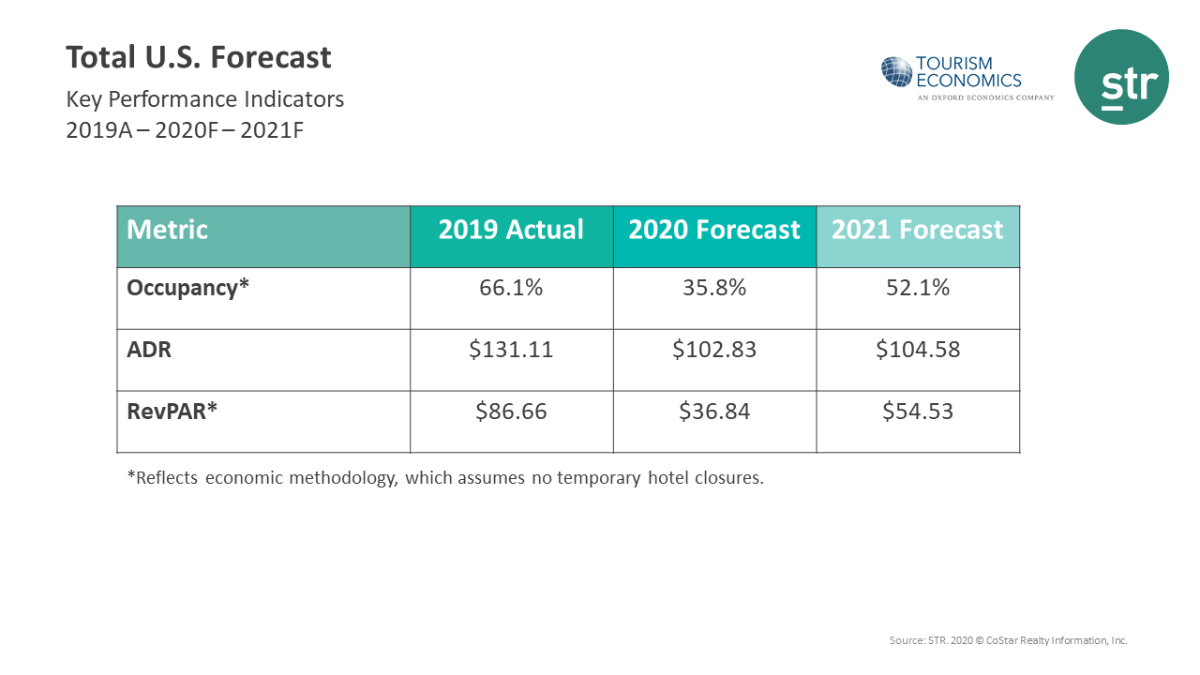

HENDERSONVILLE, Tennessee—The latest U.S. hotel forecast from STR and Tourism Economics projects a 57.5% decline in revenue per available room (RevPAR) in 2020, then a 48.0% increase in the metric in 2021.

Each percentage change was downgraded from a late-March forecast revision, which called for a 2020 RevPAR decrease of 50.6% followed by a 2021 increase of 63.1%.

“Performance levels are dismal from every angle, but at the very least, weekly data through May 9 indicates that the industry has already hit bottom and begun a steady ascent,” said Amanda Hite, STR president. “The rate of recovery will be slow even as distancing measures are eased and most of the country reopens. Concerns around the safety of travel and leisure activity will dictate how long it takes the industry to regain its footing. Regardless of timing, the leisure segment will be first out of the gate, especially from drive-to sources.”

“The initial recovery in travel will be uneven and staggered, with gains in many markets determined by virus-specific factors more than economic factors,” said Adam Sacks, Tourism Economics’ president. “The gradual relaxation of social distancing in the second half of this year will primarily benefit regional leisure travel with the business and group travel recovery lagging. We anticipate it may take until 2023 to recover to 2019 peak demand levels.”

Chain Scales and Top Markets

Using economic methodology, which assumes no temporary hotel closures, the luxury segment is projected for the lowest 2020 occupancy at 25.0%. Economy properties are forecasted for the highest occupancy level of 45.2%. In aggregate, the Top 25 Markets are projected to perform worse than the rest of the country. New Orleans (28.0%) and San Diego (41.1%) are expected to show the lowest and highest occupancy levels, respectively.

Property Closures

As of 14 May, STR’s database showed a total of 3,151 temporary U.S. hotel closures with 1,842 hotels reopened.

“Temporary closures came in at a lower number than we anticipated based on information back in March,” Hite said. “The properties offline will reduce national supply in several months, but we do not anticipate a significant number of permanent closures. Buyers are always out there with the confidence that they can make a property work based on the right level of transaction discount.”

A note to editors: All references to STR data and analysis should cite “STR” as the source. Please refrain from citing “STR, Inc.” “Smith Travel Research” or “STR Global” in sourcing as those names no longer fit within the STR brand.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for global hospitality sectors. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.

About Tourism Economics

Tourism Economics, an Oxford Economics company, focuses on the intersection of the economy and travel sector, providing actionable insights to our clients. We provide our worldwide client base with direct access to the most comprehensive set of historic and forecast travel data available. And our team of specialist economists develops custom economic impact studies, policy analysis, and forecast models.

Media Contacts:

Nick Minerd

Senior Director, Communications

nminerd@str.com

+1 (615) 824-8664 ext. 3305

Aran Ryan

Director, Lodging Analytics

aran.ryan@oxfordeconomics.com

+1 610 995 9600

0 Comments