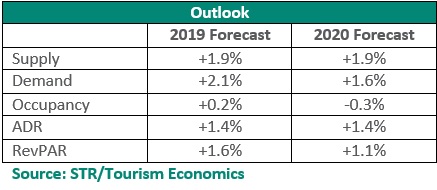

NASHVILLE—Performance growth projections for the U.S. hotel industry have been downgraded to 1.6% for 2019 and 1.1% for 2020, according to STR and Tourism Economics’ latest forecast just released at the 11th annual Hotel Data Conference.

The previous version of the U.S. hotel forecast released in June called for growth in revenue per available room (RevPAR) of 2.0% and 1.9%, respectively. With occupancy at nearly flat levels, average daily rate (ADR) has been the sole driver of RevPAR, the industry standard performance metric.

“We continue to see ADR rise below the level of inflation even as the industry operates in the highest demand and occupancy environment in history,” said Amanda Hite, STR’s president and CEO. “The absence of hotelier pricing confidence has even extended into the peak summer months, leading us to downgrade our ADR projections by 50 basis points for 2019 and 80 basis points for 2020. Those projected decreases correlate with a downgraded GDP forecast and lead to an obvious reduction in our RevPAR projection.

“Supply growth has been manageable if you look at data from a national perspective, but there are plenty of major markets and several segments—select-service mostly—that have seen the negative effects of new inventory even with consistent demand. We’re still in a RevPAR growth cycle for now, but driving profit is a real challenge for many properties around the country.”

For the last four years, STR’s forecast has ranked as the most accurate among top industry prognosticators.

2019

For 2019 as a whole, the U.S. hotel industry is projected to report a 0.2% increase in occupancy to 66.3%, a 1.4% rise in ADR to US$131.83 and a 1.6% lift in RevPAR to US$87.41.

The 2.9% RevPAR increase recorded in both 2018 and 2017 was the lowest RevPAR percentage change for the country since the recession.

Four of the Top 25 Markets are projected to report RevPAR growth of 3.0% or higher: Atlanta, Georgia; Tampa/St. Petersburg, Florida; San Francisco/San Mateo, California; and Nashville, Tennessee.

Six Top 25 Markets are forecasted for a decrease in RevPAR for the year: Houston, Texas; New York, New York; Seattle, Washington; Minneapolis/St. Paul, Minnesota-Wisconsin; Miami/Hialeah, Florida; and Washington, DC-MD-VA.

Among chain scales, the Economy segment is likely to report the largest increase in occupancy (+1.0%). Luxury chains are expected to post the highest growth rate in ADR (+2.4%). Independents are expected to see the highest jump in RevPAR (+2.4%). While all segments should report RevPAR increases for 2019, the lowest rate of RevPAR growth is projected in the Upscale segment (+0.3%).

2020

For next year, STR and Tourism Economics project a 0.3% decrease in occupancy to 66.1%, a 1.4% lift in ADR to US$133.70 and a 1.1% rise in RevPAR to US$88.40. Occupancy in the U.S. has not declined year over year since 2009.

Two Top 25 Markets are projected to report RevPAR growth of 3.0% or higher: Miami and San Francisco.

New York is the only of the major markets forecasted for a RevPAR decline.

The highest overall rate of RevPAR growth (+1.8%) is expected in the Luxury segment, while the lowest is once again projected among Upscale chains (+0.4%).

A note to editors: All references to STR data and analysis should cite “STR” as the source. Please refrain from citing “STR, Inc.” “Smith Travel Research” or “STR Global” in sourcing as those names no longer fit within the STR brand.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for global hospitality sectors. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. For more information, please visit str.com.

About Tourism Economics

Tourism Economics, an Oxford Economics company, focuses on the intersection of the economy and travel sector, providing actionable insights to our clients. We provide our worldwide client base with direct access to the most comprehensive set of historic and forecast travel data available. And our team of specialist economists develops custom economic impact studies, policy analysis, and forecast models.

Media Contacts:

Nick Minerd

Senior Director, Communications

nminerd@str.com

+1 (615) 824-8664 ext. 3305

Aran Ryan

Director, Lodging Analytics

aran.ryan@oxfordeconomics.com

+1 610 995 9600

0 Comments