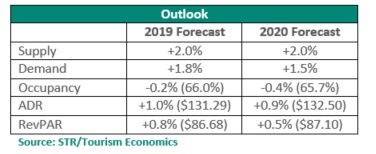

HENDERSONVILLE, Tennessee—Growth projections for U.S. hotel revenue per available room (RevPAR) have been downgraded to less than 1.0% for 2019 and 2020, according to STR and Tourism Economics’ final forecast revision of this year.

“U.S. hotels have posted nine straight years with RevPAR increases of basically 3% or higher, so growth levels below 1% will clearly represent the industry’s worst years since the recession,” said Amanda Hite, STR’s president.

The previous version of the U.S. hotel forecast released in August called for RevPAR increases of 1.6% and 1.1%, respectively. With occupancy at flat to slightly lower levels year over year, average daily rate (ADR) has been the sole driver of growth in RevPAR, the industry standard performance metric.

“At the risk of sounding like a broken record, the major factor in our revisions continues to be a lack of pricing confidence,” Hite said. “Supply growth is coming in ahead of demand growth a bit sooner than expected, so occupancy levels are slightly lower than projected. The major difference is with ADR, where we downgraded by 80 basis points for 2019 and 60 basis points for 2020. ADR has grown below the level of inflation for five consecutive quarters.

“Fortunately, demand is going to continue to grow beyond the record levels the industry has already achieved. Domestic travel continues to increase with forward-looking domestic air bookings remaining strong. Vacation intentions are also holding above last year’s levels. The trend that is not as positive, that could negatively affect demand, are the mixed results we’re seeing in overseas arrivals.”

2019

Fourteen of the Top 25 Markets are forecasted for a decrease in RevPAR for the year. The steepest declines are projected for Seattle, Washington, and New York, New York.

Of the 11 key markets projected to report RevPAR growth, four are expected to post an increase of 3.0% or higher: Atlanta, Georgia; Denver, Colorado; Phoenix, Arizona; and San Francisco/San Mateo, California.

A shift from the previous forecast, the Top 25 Markets in aggregate are projected for a worse RevPAR comparison (-0.5%) than all other markets. As of September, the Top 25 underperformed the rest of the country in RevPAR growth for 11 of the last 12 months.

Among chain scale segments, Economy (+0.4%) and Independent (+0.3%) are likely to report the only occupancy increases. Luxury chains are expected to post the largest growth rate in ADR (+1.9%). Independents are expected to see the highest jump in RevPAR (+1.8%). Of the three segments projected to report RevPAR decreases for the year, Upscale (-0.4%) and Midscale (-0.4%) are forecasted for the steepest decline. The three chain scales projected for negative year-over-year RevPAR comparisons show the highest supply growth.

2020

Nineteen Top 25 Markets are projected to see a RevPAR increase for the year, led by Miami/Hialeah, Florida. New York is expected to record the steepest decline in the metric.

The highest overall rate of RevPAR growth is expected in the Luxury segment (+1.6%), while the steepest decline is projected among Upscale chains (-0.5%).

A note to editors: All references to STR data and analysis should cite “STR” as the source. Please refrain from citing “STR, Inc.” “Smith Travel Research” or “STR Global” in sourcing as those names no longer fit within the STR brand.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for global hospitality sectors. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.

About Tourism Economics

Tourism Economics, an Oxford Economics company, focuses on the intersection of the economy and travel sector, providing actionable insights to our clients. We provide our worldwide client base with direct access to the most comprehensive set of historic and forecast travel data available. And our team of specialist economists develops custom economic impact studies, policy analysis, and forecast models.

Media Contacts:

Nick Minerd

Senior Director, Communications

nminerd@str.com

+1 (615) 824-8664 ext. 3305

Aran Ryan

Director, Lodging Analytics

aran.ryan@oxfordeconomics.com

+1 610 995 9600

0 Comments